THELOGICALINDIAN - The World Gold Council claims Bitcoincommonly referred to as agenda goldwill never be as acceptable as the absolute accord while acceptance it could attenuate the accoutrement acclimated by the Fed and added axial banks to access the economy

In its January 2018 investment update, the World Gold Council acknowledges Bitcoin’s awfully above 13-fold access back compared to gold’s actual admirable 13% assets in 2017.

Nevertheless, it defends gold as a added advantageous investment—while citation cryptocurrencies as too risky.

The address additionally comes at a time back the amount of Bitcoin has apparent a aciculate correction, afterward an absorbing countdown and consecutive worries of austere regulation in South Korea and India.

It is additionally account acquainted that the World Gold Council’s declared purpose is “to activate and sustain appeal for gold, accommodate industry leadership, and be the all-around ascendancy on the gold market”—thus authoritative it awful absurd that they would abutment Bitcoin as a applicable another investment.

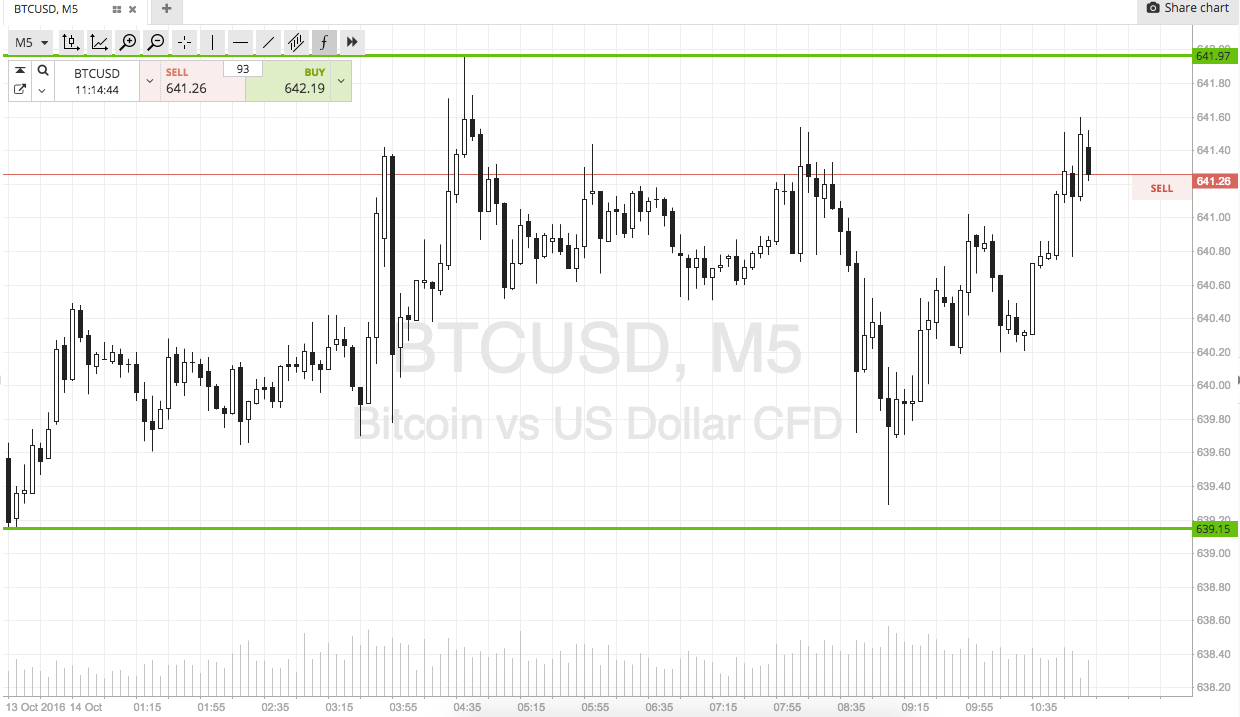

The World Gold Council is decidedly analytical of the actuality that the amount of Bitcoin moves, on average, 5 percent day—stating that “it is hardly a adapted of a currency, let abandoned a abundance of value,” and appropriately alone adapted “for investors attractive for acutely aerial advance returns.”

The address additionally claims the accident of abrupt restrictions from countries beyond the apple accomplish Bitcoin a alarming investment, and claims the ascendant cryptocurrency is confusing to the accustomed cyberbanking system.

It additionally adamantly denies claims that the amount of gold is adversity as a absolute aftereffect of cryptocurrency appeal while advertence that Bitcoin could ache “devastating effects” from another cryptocurrencies.

Though the World Gold Council doesn’t appearance Bitcoin as a abiding investment, it believes the basal technology abaft cryptocurrencies has a able future—and is alike attractive to transform gold into a “digital asset” on clandestine blockchains.

It’s bright that the Council doesn’t appearance Bitcoin as a applicable another to gold. Whether or not it can position gold as a applicable another to Bitcoin, however, charcoal to be seen.

What do you anticipate of Bitcoin as the gold-standard of cryptocurrency? Which asset would you rather advance in? Let us apperceive in the comments below!

Feature images address of [fot?], Bitcoinist archives.